Backbone Insights Report: 2024 Cyber Week Trends and Takeaways

Overall, Cyber Week 2024 showcased significant shifts in consumer behavior and marketing strategies. Earlier sales dispersed shopping patterns beyond traditional peak days like Cyber Monday, as consumers shopped throughout the week. Brands that balanced strategic sale timing with limited discounting maintained strong performance while preserving brand equity. Low-to-mid-priced products experienced more demand, outpacing high-ticket items, while direct traffic and brand-building efforts proved vital for growth. SMS outreach emerged as a standout channel, delivering strong conversion rates and driving more traffic than organic social. Additionally, affiliate marketing programs saw remarkable growth, doubling their share of revenue from paid channels and solidifying their role as a key contributor to performance. These insights underscore the value of leveraging diverse, customer-focused strategies to match evolving consumer behavior. Dig into the specifics below.

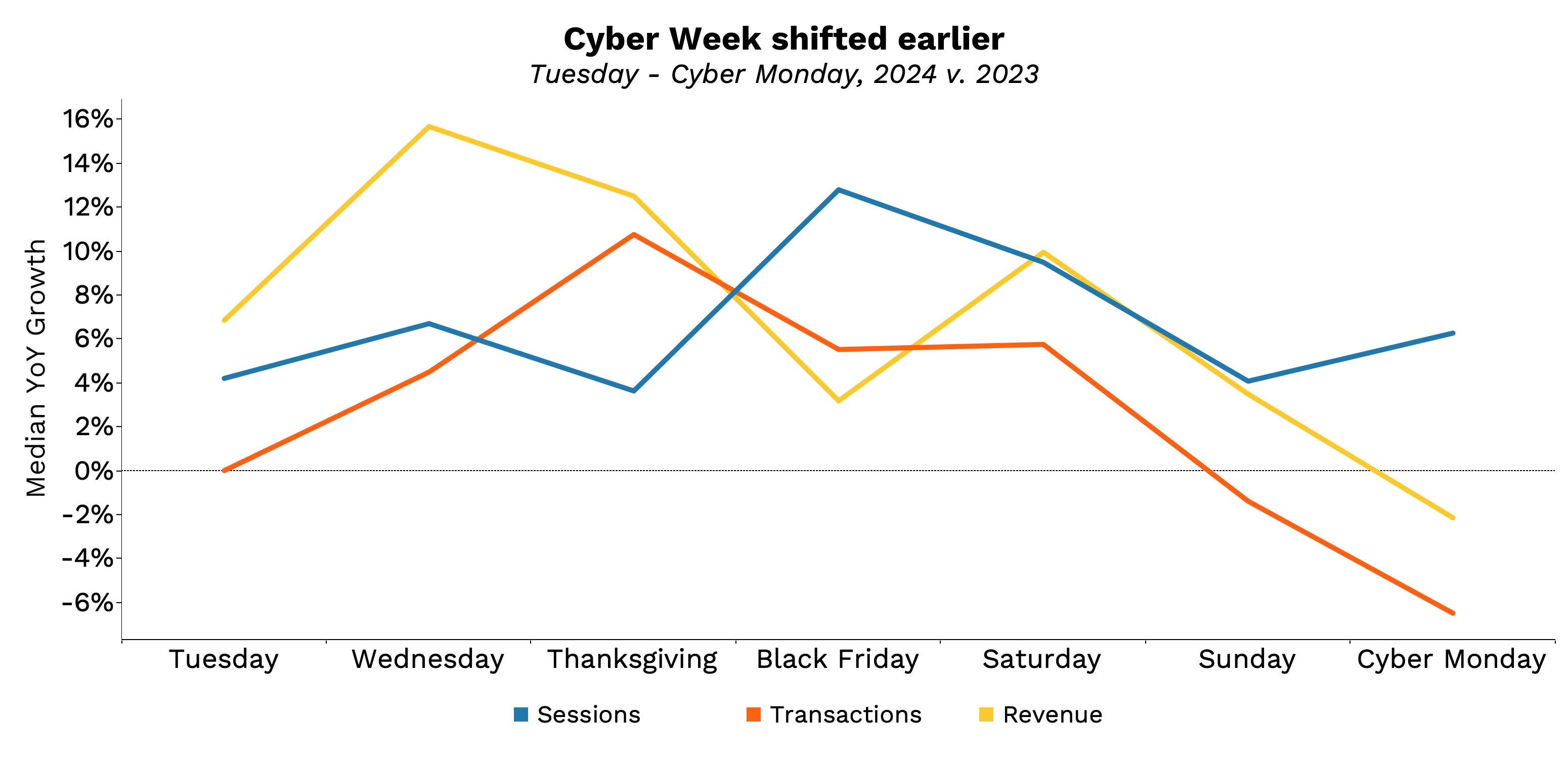

1. Cyber week purchasing shifted earlier

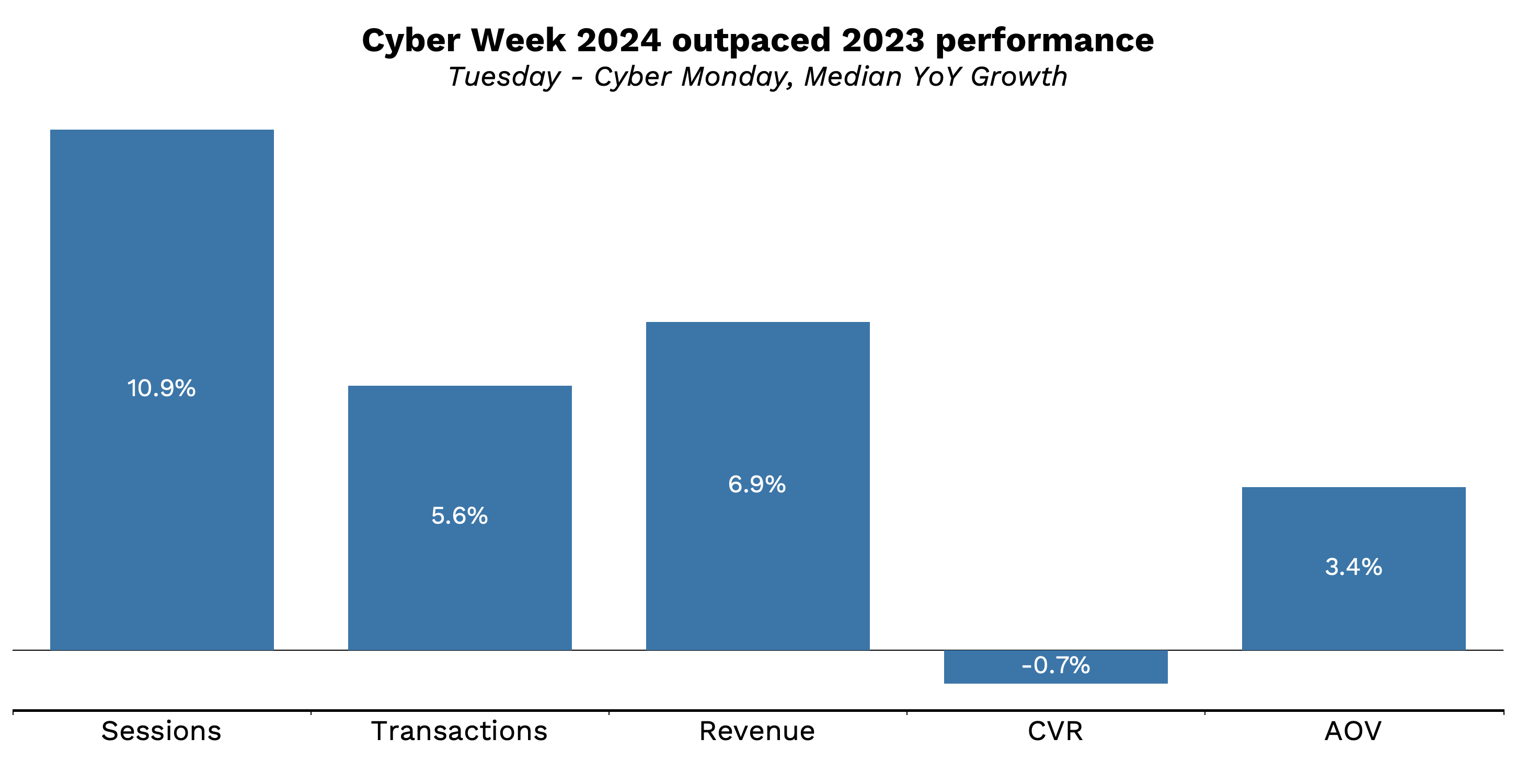

E-commerce revenue (+7%) and traffic (+8%) grew across our median brand sample, YoY, but sales shifted earlier in the week. Cyber Monday had lower revenue and traffic growth than any other day of the week.

- Black Friday and Cyber Monday were still the biggest revenue-driving days of the week, but the five non-BFCM days accounted for over 50% of the week’s total revenue and experienced strong growth from last year.

- Cyber Monday was the only day of the period that experienced YoY declines in transactions, revenue and sessions.

- With online sales starting earlier than ever, this may be a signal that consumers are no longer waiting for Cyber Monday to buy online.

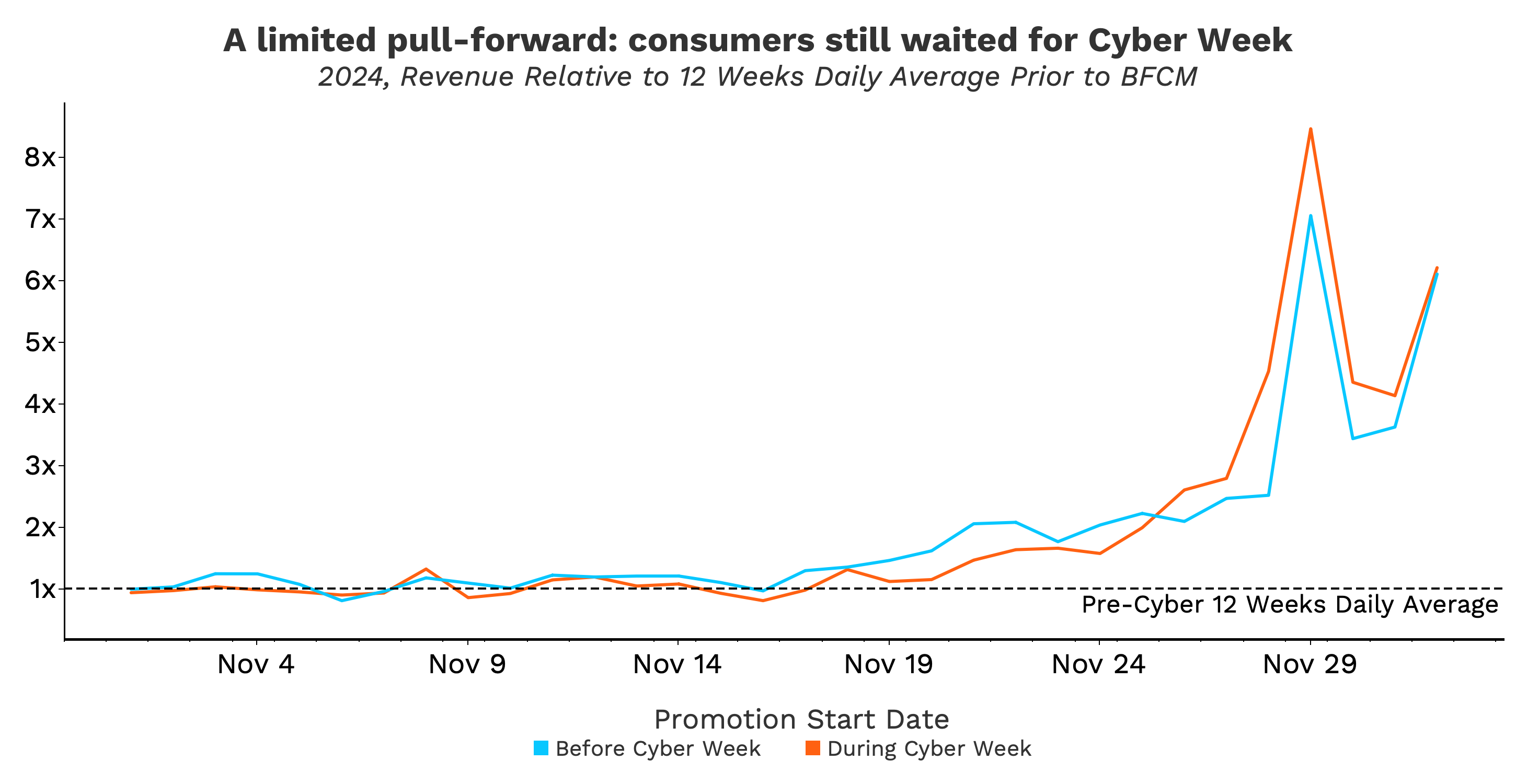

2. Despite earlier sales, consumers waited for Cyber Week to purchase

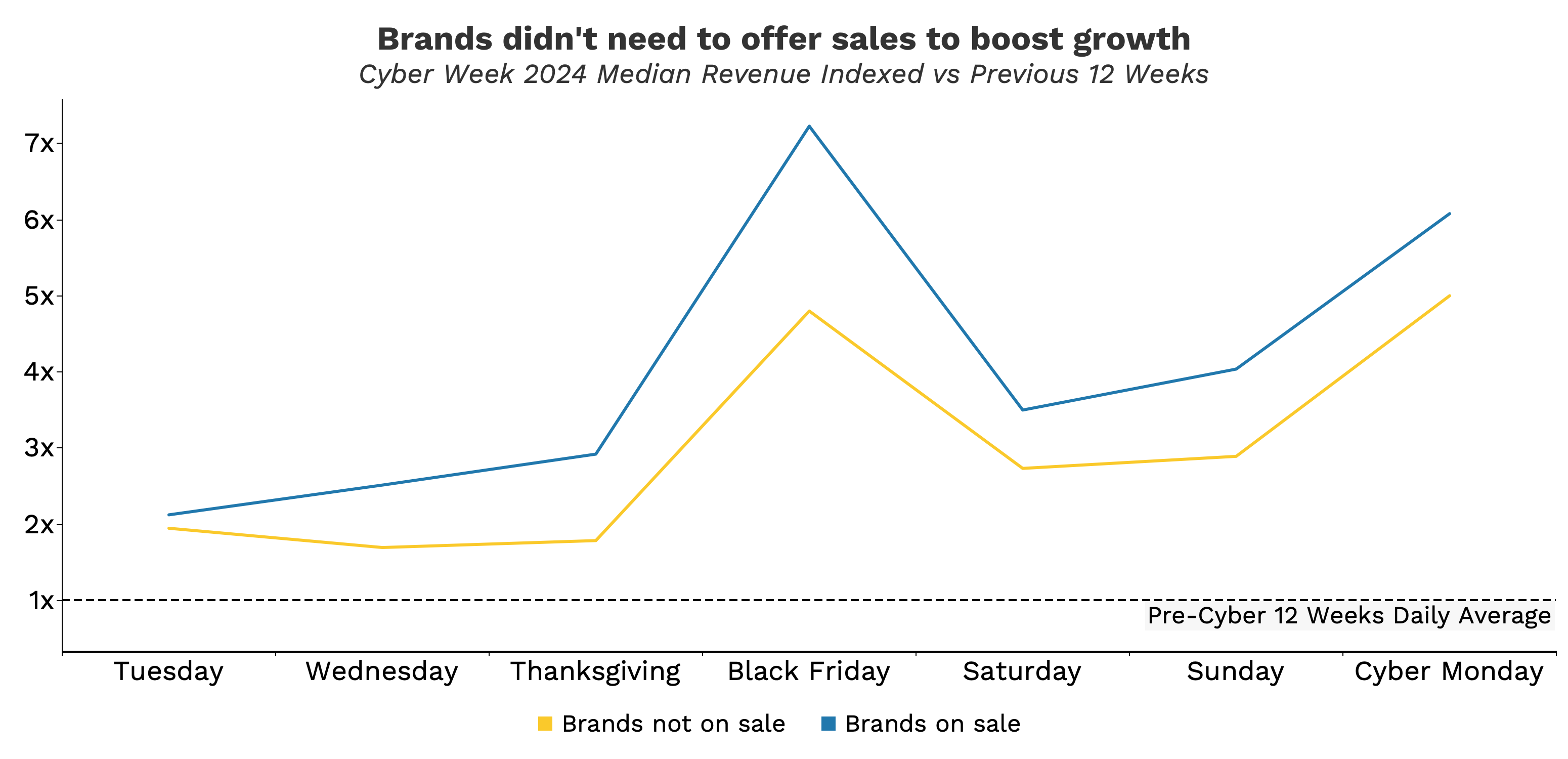

Despite the widely discussed “pull-forward” effect on holiday shopping demand, most consumers still conducted the bulk of their purchases on Black Friday and Cyber Monday, even as some brands offered sales early.

- Sales volume during primary Cyber Week days was still 5-8x higher than daily averages from the preceding weeks.

- Brands that chose to hold sales earlier generated 1.3x more revenue compared to those that stuck to conventional sale days in the period leading up to Cyber Week. During Cyber Week, brands that held traditionally timed sales generated 1.15x more revenue than the brands that started sales earlier.

- Waiting to go on sale appeared slightly more beneficial, overall. Brands that held sales only during Cyber Week generated 1.05x more revenue than brands that started sales early during the entire period from November 16 to December 2, 2024.

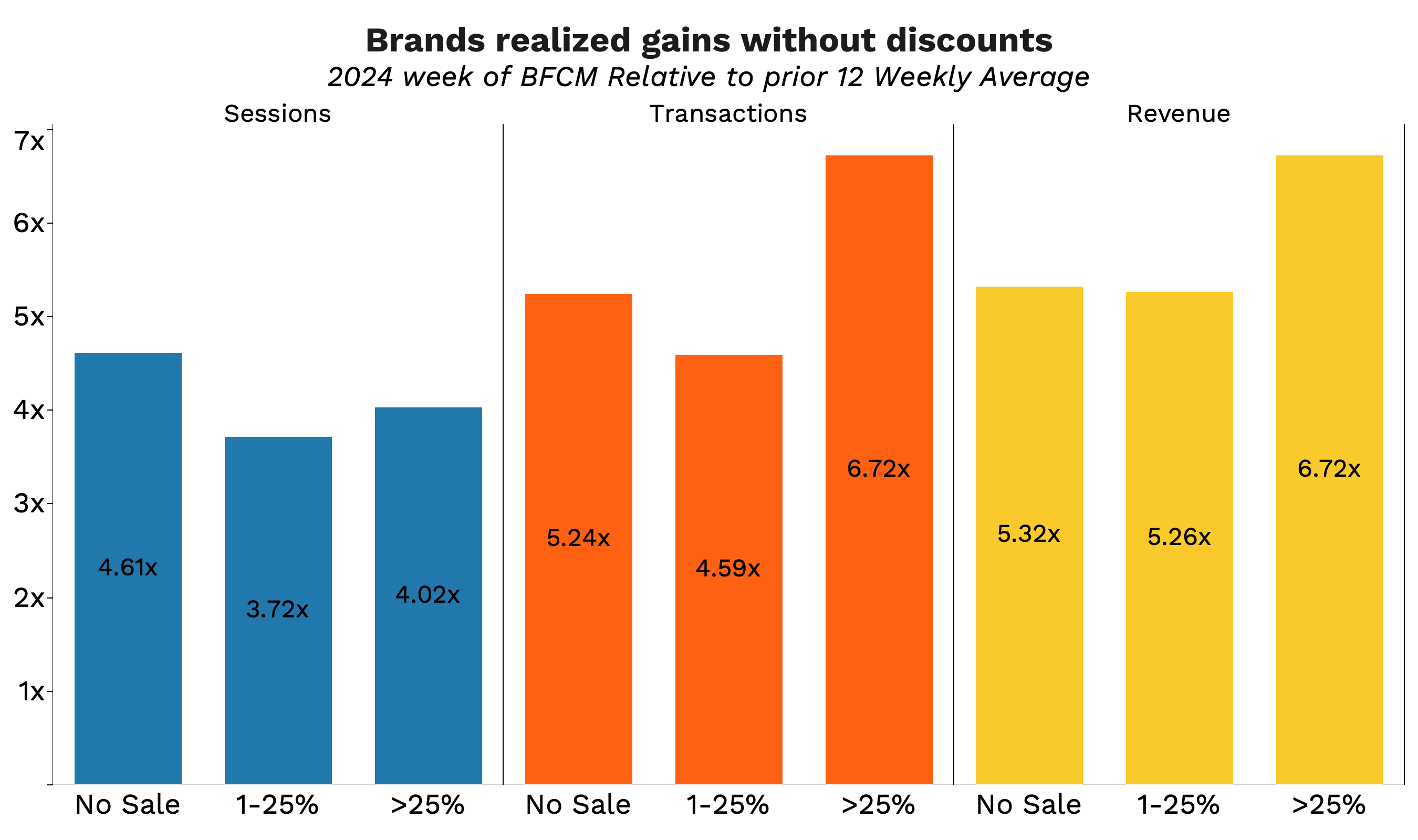

3. Brands didn't necessarily need to offer sales to boost revenue

Cyber week sales offered only modest boosts to transactions and revenue for brands. Session volume between sale and non-sale brands was nearly identical, indicating that consumers were still showing interest, and often still purchased, non-discounted products. This effect was amplified depending on the average amount of product discount. Average discounts of 25% or less produced no discernible effect on transactions or revenue while average discounts over 25% produced modest gains.

In some cases, Cyber Week sales may not be worth the costs of lower margins and diminished brand health. Relying on promotions can create a price-sensitive consumer base and can change brand perceptions from quality-focused to price-focused.

- Brands that offered average discounts of 25% or less experienced the same revenue increases as brands that remained full-price.

- Brands that offered average discounts over 25% only realized 1.26x higher revenue increases than brands that remained full-price.

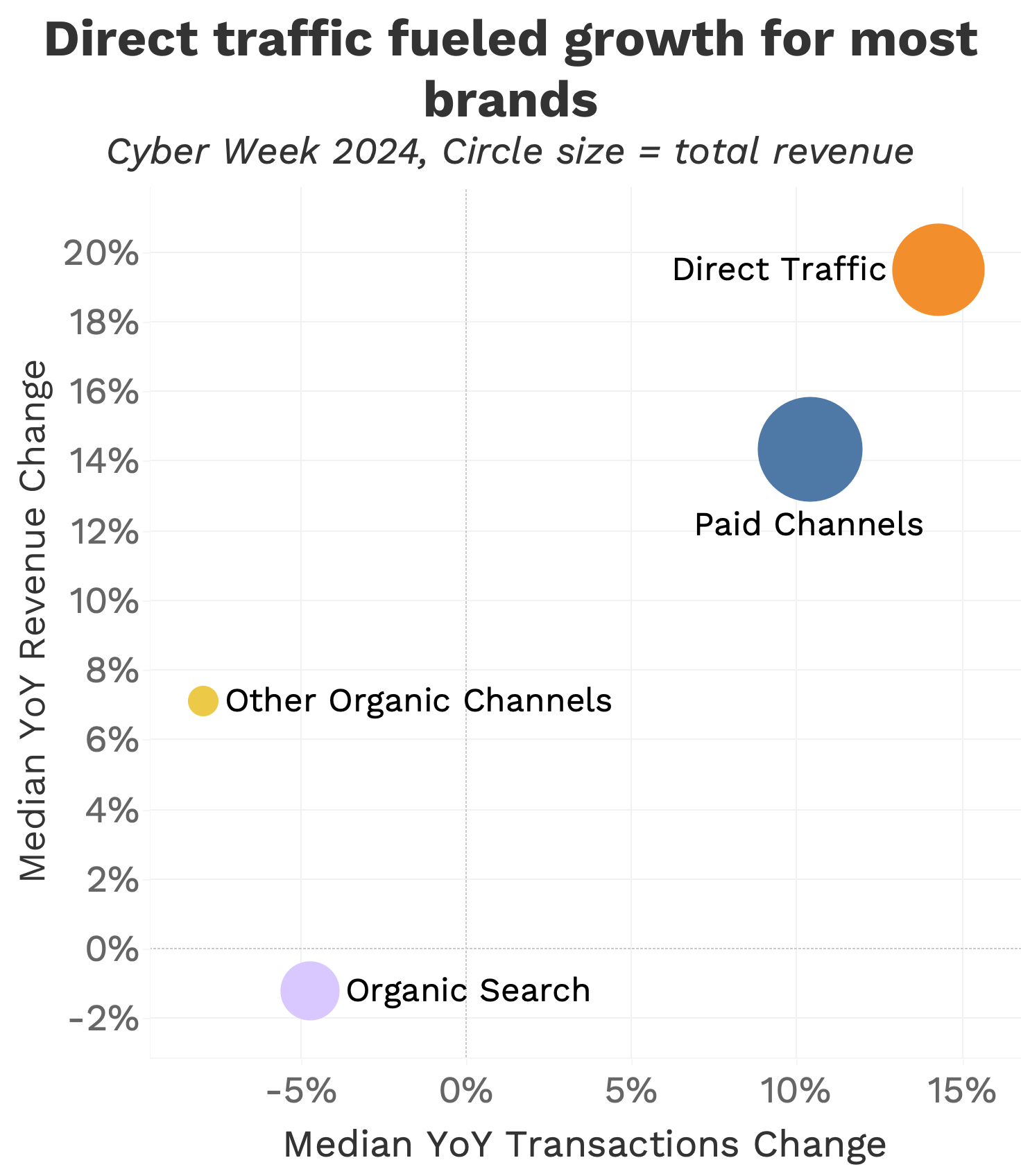

4. Non-click-based impressions proved vital as direct traffic fueled growth

For most brands, revenue from direct traffic outpaced growth in paid and organic channels. This captured purchasers who navigated directly to websites and who were likely influenced through non-direct response marketing like earned coverage, CTV, Video, YouTube, Audio, and some formats on paid social.

- The highest revenue growth and highest volume of revenue mean that direct traffic was the biggest contributor to bottom line gains this year.

- Median YoY Revenue growth from direct traffic topped 19% in 2024.

- Consumers didn’t just need direct response advertising to purchase online, even during sales. Brand advertising, community building and other indirect methods likely provided a foundation of growth during these periods.

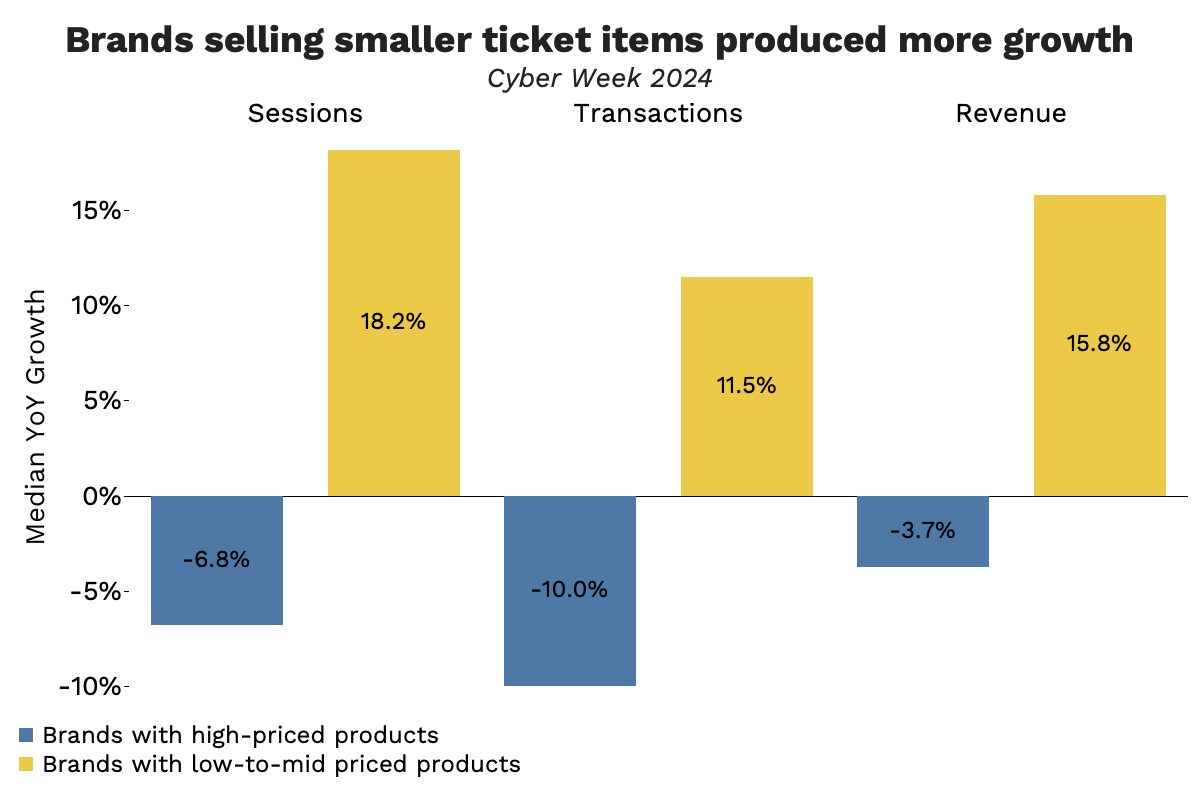

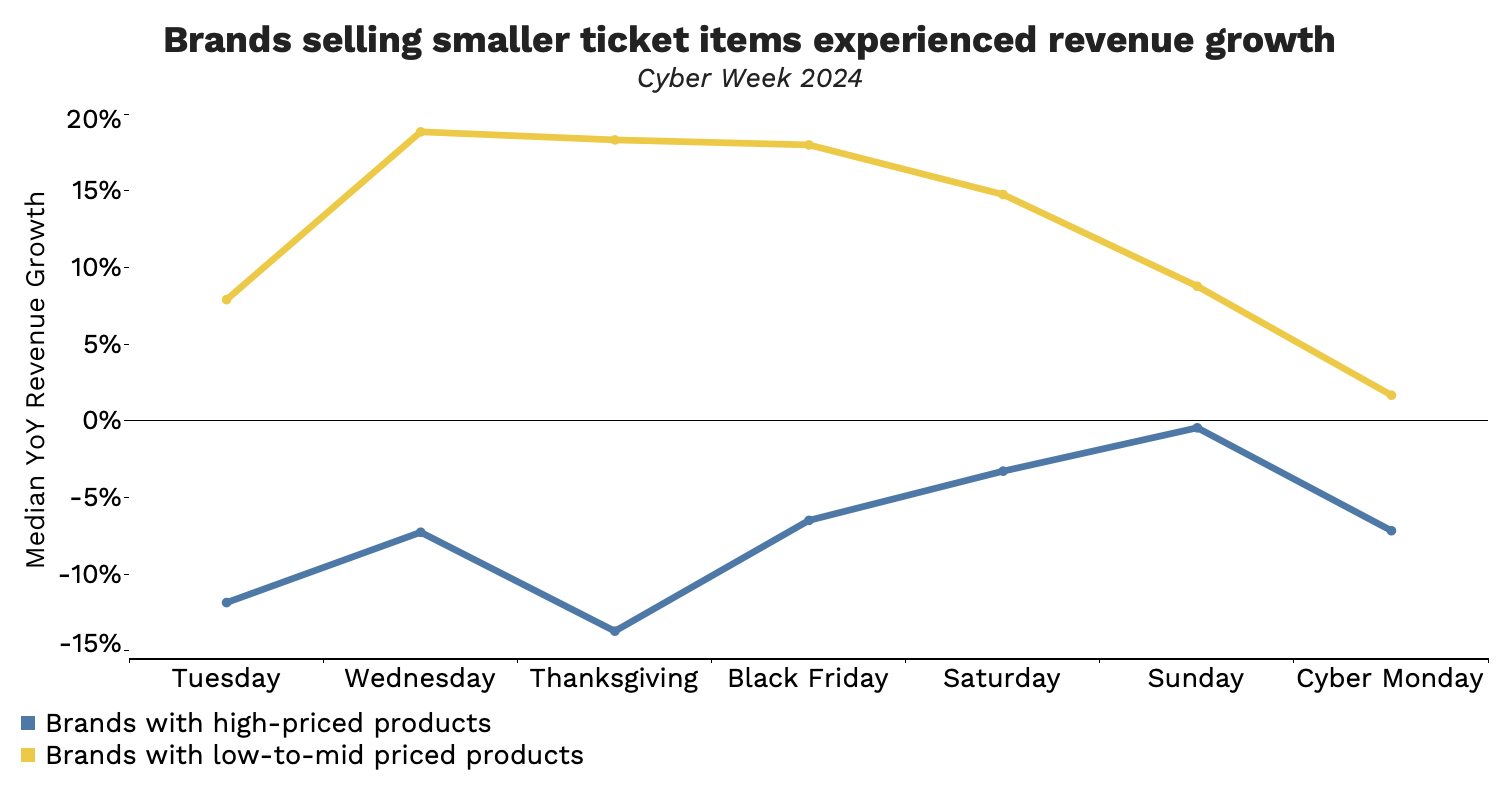

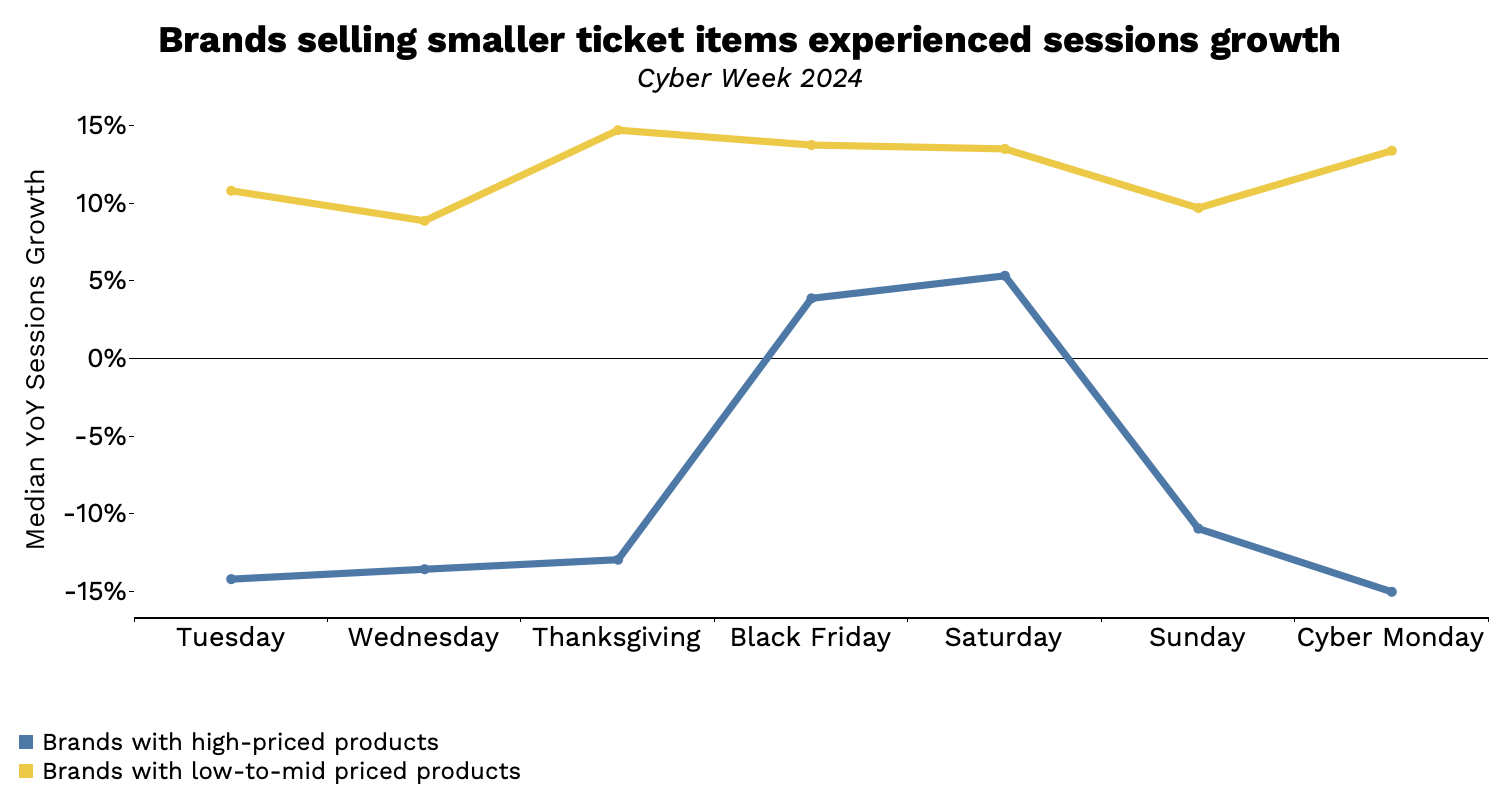

5. Brands with high ticket items struggled while brands with low-to-medium ticket items achieved growth.

This year emphasized smaller purchases over big-ticket items. While growth in traffic for brands with high-priced products did occur during some days, consumers may have been more price sensitive in 2024. In contrast, low-to-mid priced brands capitalized on steady demand, sustaining double-digit, median revenue growth.

- Median, YoY transaction growth contracted 10% for brands with high ticket items (over $200) during Cyber Week.

- Higher-priced items experienced a median decline in sessions (-6.8%) compared to last year, though Black Friday and Saturday saw a temporary uptick. While this bump brought transactions (-10.0%) closer to a positive YoY figure, it wasn’t enough to surpass 2023 levels.

- Conversely, brands with products in the low-to-mid priced tier (under $200) experienced significant YoY increases across key metrics.

- Traffic grew steadily, with median 18.2% sessions growth, showing consistent interest throughout the period rather than concentrated spikes.

- Transactions (+11.5%) and revenue (+15.8%) peaked before Black Friday, maintaining positive growth through Cyber Monday.

6. An emphasis on SMS outreach proved lucrative

Many brands appeared to reach more customers through the channel than last year as sessions from the channel surged. This was likely part of a widespread strategy to connect with consumers directly and leverage valuable 1p customer data. That volume scaled well with a median, YoY conversion rate growth of 18%.

- SMS experienced the largest, median revenue and transaction growth among major channel groups.

- SMS experienced exceptional median, YoY conversion rate growth (+18%) as traffic scaled, the highest among paid advertising channels.

- SMS assumed a higher share of visitors than organic social, doubling from last year to nearly 4%.

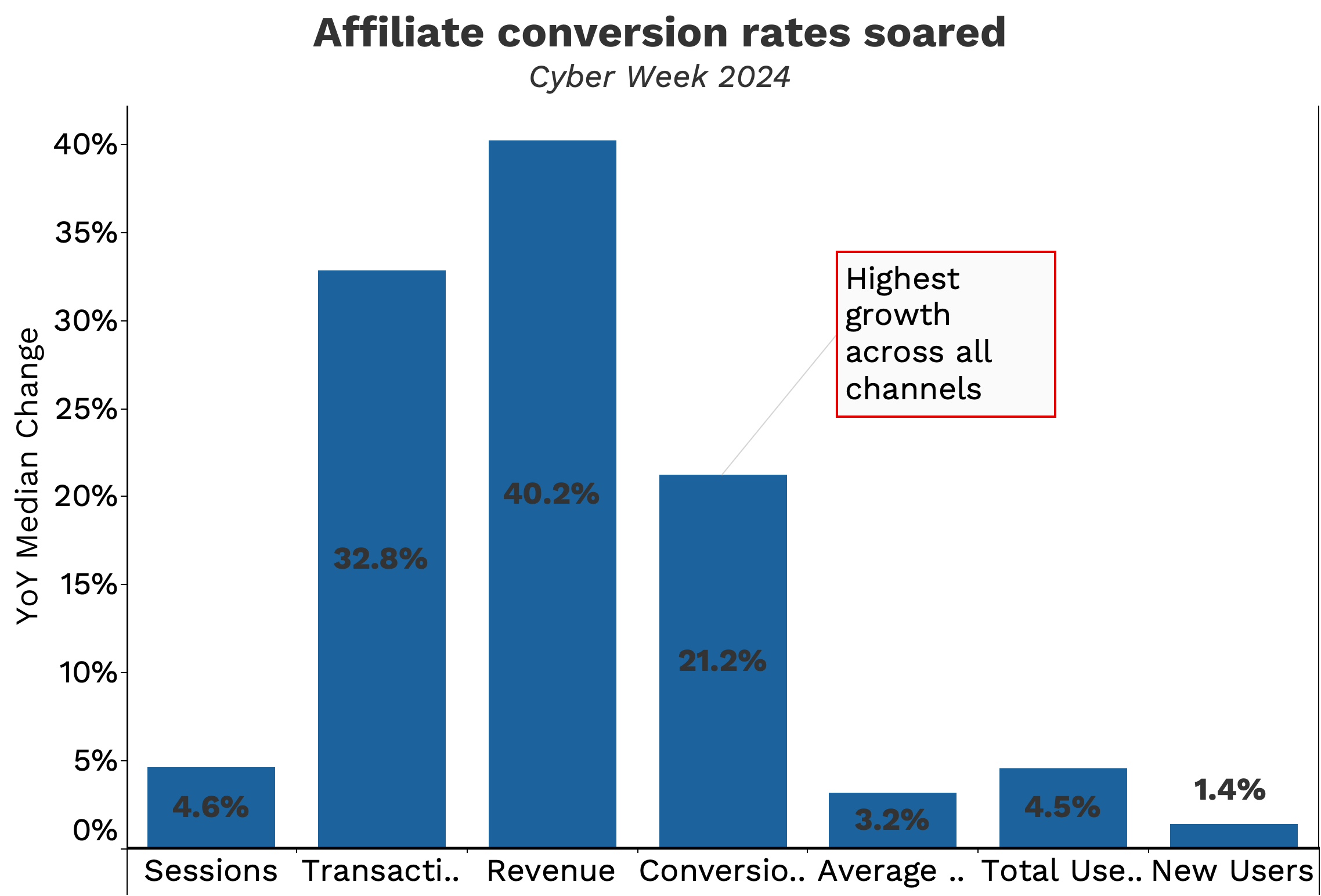

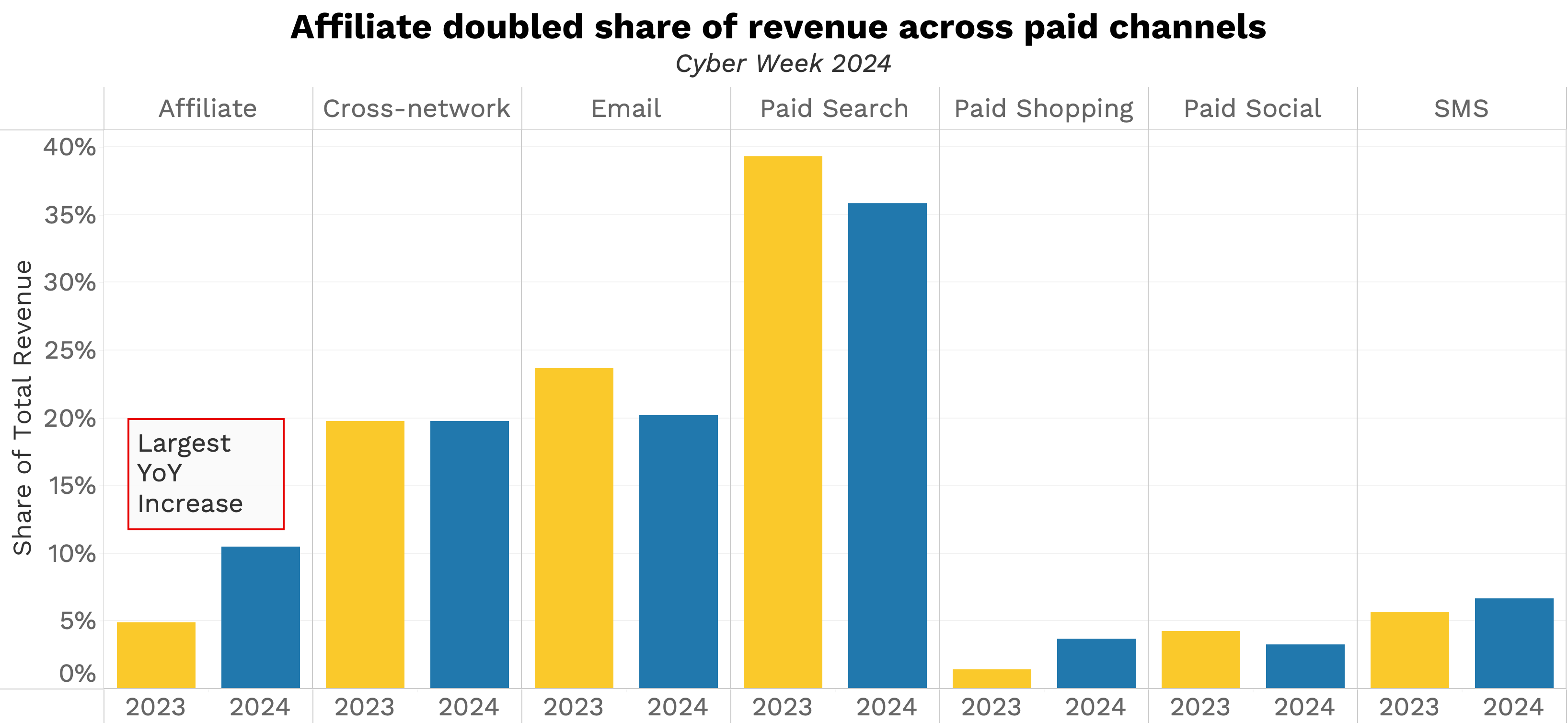

7. Affiliate doubled share of revenue across paid channels

Brands investing in upper-funnel Affiliate programs were rewarded with high conversion rates and revenue growth in the channel. The data used in this analysis primarily measures the impact of upper-funnel Affiliate tactics like content marketing, influencers, and more.

- Among brands that ran programs, Affiliate was among the highest growing channels in every category with YoY 40% median revenue growth and 21% median conversion rate growth.

- Affiliate’s share of revenue across paid channels climbed from 5 to 10% in 2024.

About Backbone’s Data

The insights herein were compiled using GA4 data from Backbone’s sample of (anonymized) brands and was analyzed by Backbone’s Data & Analytics team.

If you’re curious about how these insights should inform your brand’s 2025 strategy, reach out to us at info@backbone.media.